A

ALLO

Guest

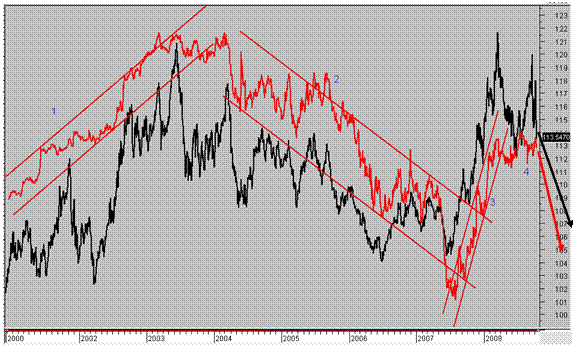

Here is a little article about how the bond market is about to crumble. Now bonds are thought to be one of, if not the safest place to put ones money. What does that tell you about how bad it is if one of the safest places to put money is about to collapse?

Imagine a country such as Venezuela announced that it was bailing out an investment bank, then just days later said it was nationalizing its mortgage industry, and then just days later that it was bailing out its biggest insurance company, and then just days later its government pledged 700B$ to inject into its failing banks, and then just days later its stock market fell 20%. Would you feel comfortable having your money invested in such a country, in its stock market, in its bond market or in its currency?

I hope you answered ?No? or ?Hell, No!? to the above question! So why should you feel any different about the situation if the country is called ?America?? I am going to show you that the US Bond market is on the brink of collapse and with it will come the collapse of the currency, just as you would expect to be the outcome of such ridiculously inflationary policies in any other country.

http://news.goldseek.com/GoldSeek/1223911533.php

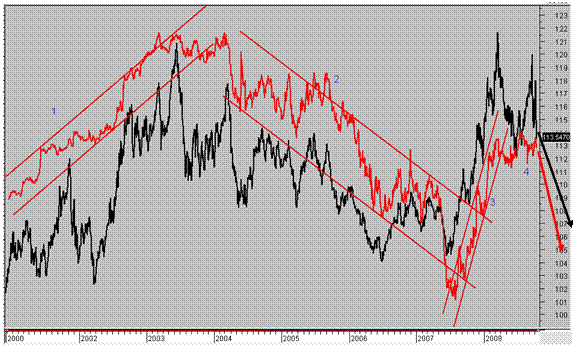

Imagine a country such as Venezuela announced that it was bailing out an investment bank, then just days later said it was nationalizing its mortgage industry, and then just days later that it was bailing out its biggest insurance company, and then just days later its government pledged 700B$ to inject into its failing banks, and then just days later its stock market fell 20%. Would you feel comfortable having your money invested in such a country, in its stock market, in its bond market or in its currency?

I hope you answered ?No? or ?Hell, No!? to the above question! So why should you feel any different about the situation if the country is called ?America?? I am going to show you that the US Bond market is on the brink of collapse and with it will come the collapse of the currency, just as you would expect to be the outcome of such ridiculously inflationary policies in any other country.

http://news.goldseek.com/GoldSeek/1223911533.php